Selling your business continuity program to your internal stakeholders is a lot like telling your kid to eat her veggies while yours are neatly swept onto the rim of your plate or otherwise smothered in ranch and cheese.

You know they’re good for you, but how do you convince your kid that all those vitamins, minerals, and fiber wrapped up in tasteless green crunch are so worth it to a future life of cognitive acuity, physical prowess, and averted disease?

Similarly, while everyone touts that business continuity is important, it’s often hard to pinpoint how it tangibly benefits your bottom line. Understanding, internalizing, and communicating the value of your business continuity program is a challenge for nearly every business continuity professional that I know.

But unfortunately, unlike all of your unwanted veggies, business continuity can’t be conveniently ignored by smothering it in creamy cheesy goodness or brushing it into the compost bin as you shoulder check for witnesses.

The boom will eventually hit and before it does, you need to ensure that all of your stakeholders—from the C-suite to service reps—understand the value of a consistent and coordinated approach to business continuity and crisis management.

Here are some ways to do it.

Why It’s So Hard to Quantify the Value of Your Business Continuity Program

Like the older brother who cleaned grease traps at Wendy’s for two years to buy a sensible ‘98 Camry watching the youngest get the keys to a shiny late-model Honda at age 16, it’s hardly fair that business continuity has to work so hard against big brothers like HR and finance for its share of resources.

But with business continuity a relatively new player in the modern business organization, it’s a hard reality that all business continuity professionals struggle with.

Let’s take a small detour to MBA land to understand the reasons why.

In modern financial terms, we measure our investments—whether in buildings, machinery, or business continuity planning—by the economic value added. Economic value-added, or EVA, is essentially the sum of additional cash flows that accrue over time as a result of a particular investment.

When that investment is in something like improved supply chain efficiencies, better equipment, or new software, the economic value added is relatively straightforward. Serve your customers faster, better, and more efficiently, and cash flows will inevitably improve and give you a solid show for return on investment.

But measuring a direct financial impact that results from your investment in business continuity is a bit more challenging, in part, because of accounting standards and regulatory oversight. To protect less-awares investors from bad actors who play card tricks and shell games to pad company valuations and sell out before anyone is wise to their scheme, the Securities and Exchange Commission, among others, highly regulates accounting practices, and more specifically, how business value is calculated. So although investments in business continuity might add value over the long-term, that direct value add can’t be calculated in a way that satisfies accounting and valuation rules in the short term.

To illustrate, let’s look at what a typical investment in business continuity planning might look like for a brick and mortar business, like Walmart or Costco. It’s not uncommon for these businesses to spend several million each year to procure assets that can be deployed to mitigate loss in the event of a natural disaster or weather event. This might include truck-mounted generators, light towers, building supplies, and other items needed to reconstruct a site.

If all goes well, those resources could sit unused for months or years before being deployed. In the meantime, they’re accumulating a large negative return on investment because no one is deriving a tangible benefit in the absence of the need for a disaster response; they just invested $26 million for something that COULD happen but hasn’t yet. Amortized over 10 years, you’re looking at a large negative return on investment each year.

Yet in year eleven, when a major hurricane like Sandy hits, that investment in business continuity will pay off handsomely. But how do you justify that expense again a negative return on investment for years 1 through 10?

You don’t.

At least not using a traditional model of business valuation.

Here’s what to do instead.

Want to learn more about Business Continuity?

Our Ultimate Guide to Business Continuity contains everything you need to know about business continuity.

You’ll learn what it is, why it’s important to your organization, how to develop a business continuity program, how to establish roles & responsibilities for your program, how to get buy-in from your executives, how to execute your Business Impact Analysis (BIA) and Business Continuity Plans, and how to integrate with your Crisis Management strategy.

We’ll also provide some perspectives on how to get help with your program and where to go to learn more about Business Continuity.

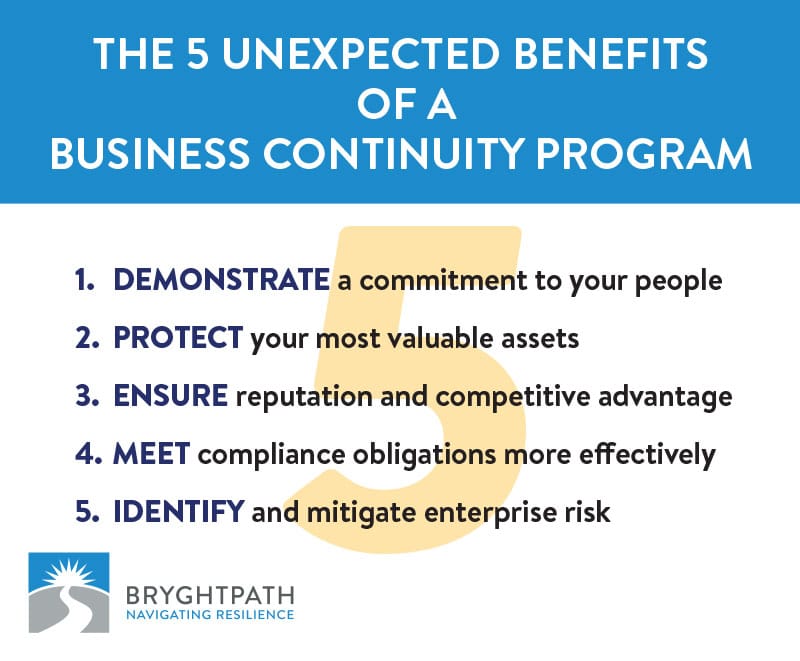

5 Ways to Communicate the Value of Your Business Continuity Plan

I always advise business continuity professionals to have a well-rehearsed elevator pitch for explaining the value of their program to the organization; you should be prepared to take advantage of every opportunity to advocate for your program.

If that pitch includes: “because audit said so” or “so many regulations” you’ll be lucky to convince your board to commit to purchasing a department Keurig, let alone a serious investment in business continuity planning.

If you’re wondering what to say instead, here are some of the ways we explain the value of a business continuity and crisis management program to help our consulting clients win over their internal stakeholders:

1. Investing in business continuity demonstrates that you value your people.

Amidst the primacy of environmental, social, and governance concerns, calls for true workplace diversity, and the squeeze of the “Great Reshuffle,” it’s more important than ever to take care of your people. Having a business continuity program in place is critical to doing so.

Not only will you better protect human life and safety; you’ll also position your team to respond more quickly to recover, protect, and recover your organizational assets during and after a crisis. Your employees are your most important crisis management tool and investing in their well-being and safety will undoubtedly pay dividends during your next crisis.

2. Business continuity protects your organization’s most important assets.

When done right, your business continuity program should provide a structured process for identifying your organization’s most important assets and implementing a plan to hedge against the potential loss of or damage to those assets.

If your business is largely digital, that might include the need for backup storage, cybersecurity measures, and alternative software and application solutions in the event of a third-party failure. For a brick and mortar operation, those assets likely include equipment and space that is key to manufacturing, distribution, or service delivery. No two businesses are alike, which is why it’s important to have a program that’s designed to your specific needs.

3. Investing in business continuity protects your reputation and elevates you over the competition.

It can take decades to build a reputation but only minutes to destroy it.

When the next heatwave shuts down the power grid, you don’t want to be the hospital that’s forever remembered for its patients dying from heatstroke.

Conversely, you’ll be the community hero when the next hurricane hits and your grocery is the only one still open with clean water and food because you invested in structural upgrades as part of your business continuity planning process.

4. Your business continuity program helps your organization meet its compliance obligations.

While business continuity and crisis management serve a wholly different role than your compliance function, both disciplines carry significant overlap. Business continuity best practices often reflect the demands of regulatory and compliance obligations. As a result, investing in your business continuity program is also an indirect investment in helping to meet your compliance obligations.

In addition, in many instances, ensuring operational continuity is an explicit regulatory imperative. PCI for payment processors and HITRUST, EHNAC, and DirectTrust for patient health information are just a few examples.

5. An effective business continuity program helps you identify and mitigate risk.

A healthy business continuity program is to enterprise risk management as vitamin D is to calcium. You can drink milk all day long, but without vitamin D from your diet or the sun, your body can’t process all of that precious calcium to build bones, muscle, and more.

Similarly, a strong business continuity and crisis management program is rooted in identifying and preparing for specific risks, which inevitably helps your enterprise risk management team and other risk-focused teams on their mission of anticipating and avoiding those same risks. These teams also share many of the same stakeholders. So it’s no surprise that companies whose risk management and business continuity teams work together closely in a bone-building synergy create enormous value for their organization.

Conclusion

Do you need help making a case for your organization’s investment in business continuity? Bryghtpath can help.

Our team of business continuity and crisis management professionals are experts at communicating with internal stakeholders to get you the resilience resources you need and deserve. Learn more about our approach and thought process around business continuity in our Ultimate Guide to Business Continuity.

Contact us for an initial consultation or learn about our resiliency diagnosis process.

Tips for creating an effective business continuity plan

Tips for creating an effective business continuity plan